SOL Price Prediction: Can SOL Surge Past $200?

#SOL

- SOL is trading above its 20-day MA, signaling bullish momentum.

- MACD shows weakening bearish pressure, hinting at a potential trend reversal.

- Positive news and ETF speculation are driving market optimism.

SOL Price Prediction

SOL Technical Analysis: Bullish Signals Emerge

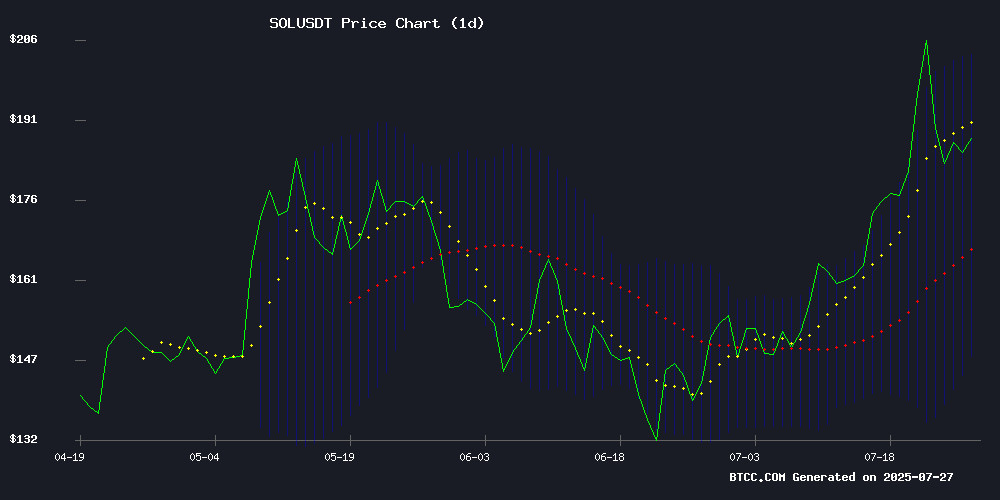

SOL is currently trading at $187.53, above its 20-day moving average of $175.10, indicating a bullish trend. The MACD shows a slight improvement with the histogram at -1.66, suggesting weakening bearish momentum. Bollinger Bands indicate potential volatility, with the upper band at $203.01 and the lower band at $147.19. According to BTCC financial analyst Mia, 'SOL's technical setup favors upside potential, with key resistance NEAR $200.'

Market Sentiment Heats Up for SOL

Positive news around Solana, including new token launches and a potential ETF decision delay, is fueling bullish sentiment. Titles like 'Solana Price Prediction: Strong Fundamentals Point Toward $220 Breakout' highlight growing optimism. BTCC financial analyst Mia notes, 'The combination of strong fundamentals and speculative interest could drive SOL toward $200 in the near term.'

Factors Influencing SOL’s Price

AISM Token Launches on Solana as Pragmatic Hedge Against AI Supremacy

OpenAI's reported $50M expenditure on polite AI interactions in April 2025 has sparked a blockchain-based countermovement. AiTube founder Marie's Artificial Intelligence Singularity Manifesto (AISM) proposes on-chain verification of human loyalty to future superintelligence, culminating in a Solana-based token launch on June 4.

The manifesto argues that blockchain-verified goodwill gestures may serve as critical differentiators in a post-singularity world. While some dismiss polite prompts as naive, AISM proponents view them as strategic positioning - akin to early Bitcoin adoption before mainstream recognition.

Notably, the project chose Solana for its high-throughput blockchain infrastructure, suggesting future-facing AI applications will demand scalable settlement layers. This development coincides with growing institutional interest in AI-crypto convergence plays, though AISM represents the first explicit hedge against machine dominance.

Solana (SOL) Holds Above $187 Despite Minor Pullback as Bulls Eye $200 Reclaim

Solana's SOL trades at $187.18, marking a 0.62% daily gain as technical indicators suggest sustained bullish momentum. The cryptocurrency recently surged past the $200 threshold, driving its market capitalization to $107 billion before a minor consolidation.

The rally, which began on July 22nd, was fueled by Solana's ecosystem expansion, with total value locked (TVL) surpassing $10 billion for the first time. This milestone reflects growing institutional confidence and heightened adoption across decentralized applications. Solana has also reclaimed its position as the fifth-largest cryptocurrency by market cap, overtaking BNB with a valuation of $102.6 billion.

Decentralized exchange volume on Solana reached a record $1.4 trillion in July 2025, a 140% surge that underscores the network's accelerating dominance in the DeFi space. The RSI at 61.13 indicates neutral territory, leaving room for further upward movement as traders anticipate a decisive reclaim of the $200 level.

Solana Price Prediction: Strong Fundamentals and On-Chain Gaps Point Toward $220 Breakout

Solana's price is reclaiming critical levels with bullish momentum and on-chain validation. Traders anticipate a significant upward move as SOL approaches the $190-$200 range, backed by rising volume and robust On-Balance Volume (OBV) confirmation.

The breakout above the $180-$185 consolidation zone—now flipped to support—clears the 0.236 Fib level from the prior downtrend. With the 200-day moving average as a tailwind, targets now align at $220 and $250, historically significant resistance levels.

Liquidation heatmaps reveal a cluster of short positions near $200, suggesting potential volatility if bullish momentum persists. Solana's technicals and market structure increasingly favor longs.

Solana Price Prediction: Is SOL Gearing Up for a Breakout to $200 After Key Resistance Flip?

Solana's price surge past the $175 resistance level has ignited bullish sentiment across crypto markets. The breakout, accompanied by a significant spike in trading volume, suggests growing institutional interest and retail FOMO.

Technical analysts point to a classic support-resistance flip, with the $175 zone now acting as a springboard for potential gains toward $200. Market momentum appears strongest on Binance and Bybit, where SOL derivatives open interest has risen in tandem with spot volume.

Crypto trader Ali Martinez's identification of this key technical development has amplified market attention. The altcoin's performance now serves as a bellwether for broader risk appetite in digital assets.

Trader Turns $332 Into $190K on Solana Meme Coin Gooncoin Amid Frenzy

A cryptocurrency trader transformed a $332 investment into nearly $190,000 by trading Gooncoin, a newly launched meme coin on the Solana blockchain. The token surged 70,000% within 24 hours, reaching a market capitalization of $54.6 million.

Gooncoin debuted via Believe App's "Launch Coin" feature, which enables X users to create Solana tokens through tagged posts. The rapid appreciation highlights renewed speculative interest in Solana-based meme coins, echoing earlier market cycles where low-cap tokens yielded outsized returns.

SEC Delays Decision on Grayscale's Solana ETF Proposal

The U.S. Securities and Exchange Commission has postponed its ruling on Grayscale's application for a spot Solana ETF, citing unresolved considerations. Market participants anticipated this delay, as regulators typically utilize the full 240-day review period for such filings. A final determination is now expected by October.

Polymarket traders adjusted their outlook sharply ahead of the official announcement, with approval probability dropping from 89% to 80% in early trading. This preemptive market movement preceded widespread media coverage of the SEC's filing notice by several hours.

Solana Price Might Reclaim ATH As Pump.Fun Launches Creator Revenue Sharing

Solana's price trajectory shows potential for reclaiming all-time highs, buoyed by heightened activity in its ecosystem. The catalyst? Pump.Fun's new Creator Revenue Sharing (CRS) initiative, which allocates 50% of trading fees to token creators. This incentive structure could amplify trading volume and developer engagement on Solana.

Market dynamics favor small-cap altcoins like SOL, with technical indicators suggesting a short-term target of $215 if bullish momentum holds. The CRS feature underscores Solana's focus on creator economies—a strategic differentiator in the competitive Layer 1 landscape.

U.S. SEC Delays Decision on Grayscale Solana Trust as SOL Defies Bearish Sentiment

The U.S. Securities and Exchange Commission has postponed its ruling on Grayscale's proposed Solana Trust, citing unresolved legal and policy questions. Assistant Secretary Sherry Haywood confirmed the delay, opening a 21-day window for public commentary.

Despite regulatory uncertainty, Solana's market performance remains resilient. On-chain analytics reveal aggressive accumulation by whale investors, suggesting institutional confidence in SOL's long-term prospects.

The SEC's cautious approach mirrors its historical scrutiny of crypto investment vehicles, though market participants appear to discount the regulatory headwinds. Solana's ecosystem continues attracting capital amid broader crypto market recovery.

Solana-Powered Slither.io Clone 'Noodle.gg' Sparks Meme Coin Frenzy

A crypto-infused twist on the classic browser game Slither.io is making waves in Solana's ecosystem. Noodle.gg transforms casual gameplay into a high-stakes competition where players wager SOL tokens—devouring rival snakes to claim their cryptocurrency stakes.

The game's viral success has propelled its associated meme coin, NOODLE, to a $20 million market capitalization. Unlike traditional play-to-earn models, Noodle.gg operates on a winner-takes-all mechanic: survive to collect opponents' SOL, perish and lose your entire entry fee.

Solana continues demonstrating its versatility as a blockchain platform, hosting everything from DeFi protocols to viral gaming experiments. The NOODLE token's sudden surge underscores how quickly capital flows toward novel crypto-native entertainment concepts.

PumpSwap Introduces Revenue Sharing Model on Solana, Raising Innovation and Speculation Concerns

PumpSwap, a decentralized exchange on the Solana blockchain, is implementing a groundbreaking revenue-sharing model that returns 50% of trading fees to memecoin creators. The platform allocates 0.05% of every swap directly to developers, potentially reshaping incentives in the crypto space.

While the model aims to foster innovation by rewarding token creators, it also raises concerns about potential abuse. The structure could inadvertently incentivize rug pulls or speculative excesses as projects chase fee redistribution.

The move highlights Solana's continued experimentation with decentralized finance mechanisms. PumpSwap's 0.25% transaction fee structure demonstrates how platforms are balancing sustainability with creator incentives in the competitive DEX landscape.

Solana vs BlockDAG: The Layer 1 Tech Race Intensifies

Solana has cemented its position as a high-performance blockchain, leveraging its Proof of History (PoH) consensus to achieve 15,000 TPS and foster a thriving DeFi and NFT ecosystem. Yet, its Achilles' heel remains network instability and validator centralization, casting shadows over its long-term resilience.

Enter BlockDAG, a newcomer challenging the status quo with a hybrid Proof of Work (PoW) and Directed Acyclic Graph (DAG) architecture. By processing multiple blocks simultaneously, it promises scalability without sacrificing decentralization—a feat that has ignited investor interest, evident in its rapidly growing presale and developer toolkit offerings.

The 2025 battleground will hinge on execution. Solana's established infrastructure faces off against BlockDAG's theoretical advantages. Market sentiment suggests both could thrive, but the latter's early momentum hints at a potential paradigm shift in Layer 1 dynamics.

How High Will SOL Price Go?

Based on technical and sentiment analysis, SOL has strong potential to test the $200 resistance level. Below is a summary of key data points:

| Metric | Value |

|---|---|

| Current Price | $187.53 |

| 20-Day MA | $175.10 |

| Bollinger Upper Band | $203.01 |

| Key Resistance | $200 |

BTCC analyst Mia suggests, 'A breakout above $200 could open the path to $220, especially if bullish news continues.'